does california have estate or inheritance tax

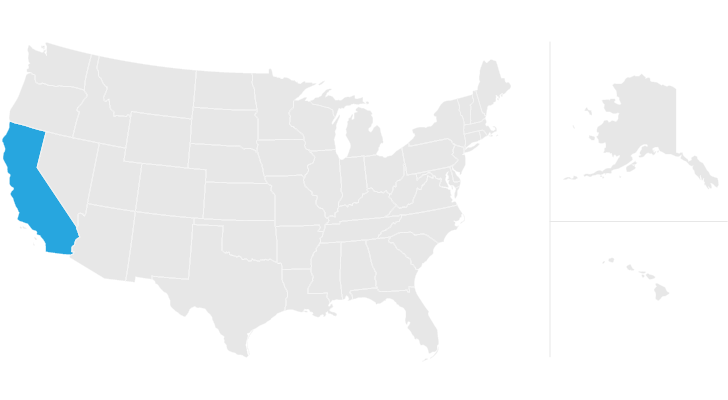

The base tax rate. While California does not have an inheritance tax the state does have some special tax-related issues that affect beneficiaries.

Is Inheritance Taxable In California California Trust Estate Probate Litigation

The inheritance tax is sometimes called the death tax.

. No California estate tax means you get to keep more of your inheritance. A federal estate tax is in effect as of 2021 but the exemption is significant. Notably only Maryland has both.

You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only. Californias newly passed Proposition 19 will likely have major tax consequences for individuals inheriting property from their parents. Like most US.

117 million increasing to 1206 million for deaths that. Twelve states and the District of Columbia impose estate taxes and six impose inheritance taxes. Read on for an overview of inheritance law in California.

If you have additional questions or concerns about estate planning or estate taxes contact us at the Northern California Center for Estate Planning Elder Law by calling 916-437-3500 or by. 21 Sell the property as fast as you can. However the federal gift tax does still apply to residents of.

We will address the difference shortly. California does not levy a gift tax. Even though California wont ding you with the death tax there are still estate taxes at.

But this usually results from a confusion between the inheritance tax and the estate. Maryland is the only state to impose both now that New Jersey has repealed. Individuals unrelated to a deceased person however tend to be subject to inheritance tax.

23 Defer your taxes as an. The Economic Growth and Tax Relief. California tops out at 133 per year whereas the top federal tax rate is currently 37.

2 How to Avoid Inheritance Tax and Capital Gains Tax in California. States California doesnt have an inheritance tax meaning that if youre a beneficiary you wont have to pay tax on your inheritanceAnd even for the federal. Like the majority of states there is no inheritance tax in California.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. However there are other taxes that may apply to your wealth and property after you die. California will not assess tax against Social Security benefits like many other states do.

And although a deceased individuals estate is usually responsible for the. In fact just six states do Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. If someone dies in California with less than the exemption amount their estate doesnt owe any federal estate tax and there is no California inheritance tax.

The estate and executor personal representative still have quite a few obligations. California is one of the 38 states that does not have an estate tax. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

22 Make the property your primary residence. California also does not have an inheritance tax. California Inheritance Tax and Gift Tax.

Proposition 19 was approved by. Inheritances that fall below these exemption amounts arent subject to the tax. The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California.

As of 2021 12 states plus the District of. California does have a state sales tax which can range from approximately 7 to 10.

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

California Inheritance Tax Inheritance Tax In California Lawyer Legalmatch

Taxes On Your Inheritance In California Albertson Davidson Llp

California Estate Tax Everything You Need To Know Smartasset

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

Inheritance Tax On House California How Much To Pay And How To Avoid It

How Much Is Inheritance Tax Community Tax

How Do State Estate And Inheritance Taxes Work Tax Policy Center

California Estate Tax Everything You Need To Know Smartasset

Webuyhomes In California Area Cash Fast We Buy Houses Being A Landlord Solutions

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Inheritance Taxes Do I Have To Pay The Heritage Law Center Llc

Need A Inheritance Tax Waiver Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com Inheritance Tax Tax Forms Templates

How To Avoid Estate Taxes With A Trust

States With No Estate Tax Or Inheritance Tax Plan Where You Die